All Categories

Featured

[/video]

Withdrawals from the cash worth of an IUL are generally tax-free up to the amount of costs paid. Any kind of withdrawals over this quantity may be subject to tax obligations depending on policy structure.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for at the very least 5 years and the person mores than 59. Properties withdrawn from a conventional or Roth 401(k) prior to age 59 may sustain a 10% penalty. Not exactly The insurance claims that IULs can be your very own financial institution are an oversimplification and can be misleading for several factors.

Nonetheless, you might undergo updating linked health and wellness inquiries that can influence your recurring costs. With a 401(k), the cash is constantly yours, consisting of vested company matching regardless of whether you stop adding. Threat and Guarantees: First and foremost, IUL plans, and the cash worth, are not FDIC insured like basic checking account.

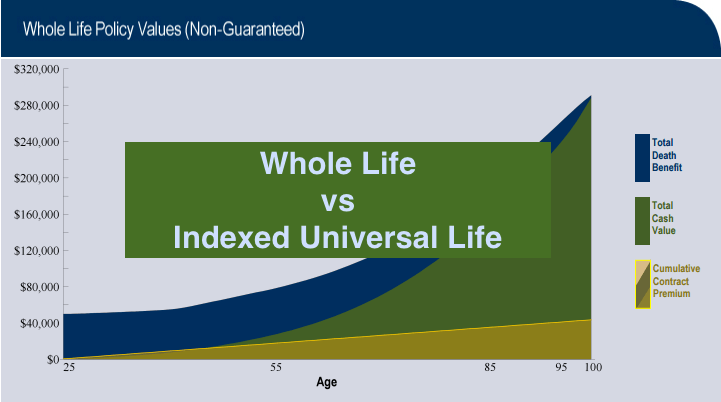

While there is typically a flooring to avoid losses, the growth potential is topped (meaning you may not completely benefit from market growths). Most professionals will concur that these are not equivalent items. If you want death advantages for your survivor and are worried your retirement financial savings will certainly not be enough, then you might intend to take into consideration an IUL or other life insurance policy item.

Sure, the IUL can give accessibility to a money account, yet again this is not the primary purpose of the product. Whether you want or need an IUL is an extremely specific question and depends upon your key monetary goal and goals. Listed below we will certainly attempt to cover benefits and constraints for an IUL and a 401(k), so you can even more delineate these items and make a much more informed choice concerning the finest means to manage retirement and taking care of your liked ones after death.

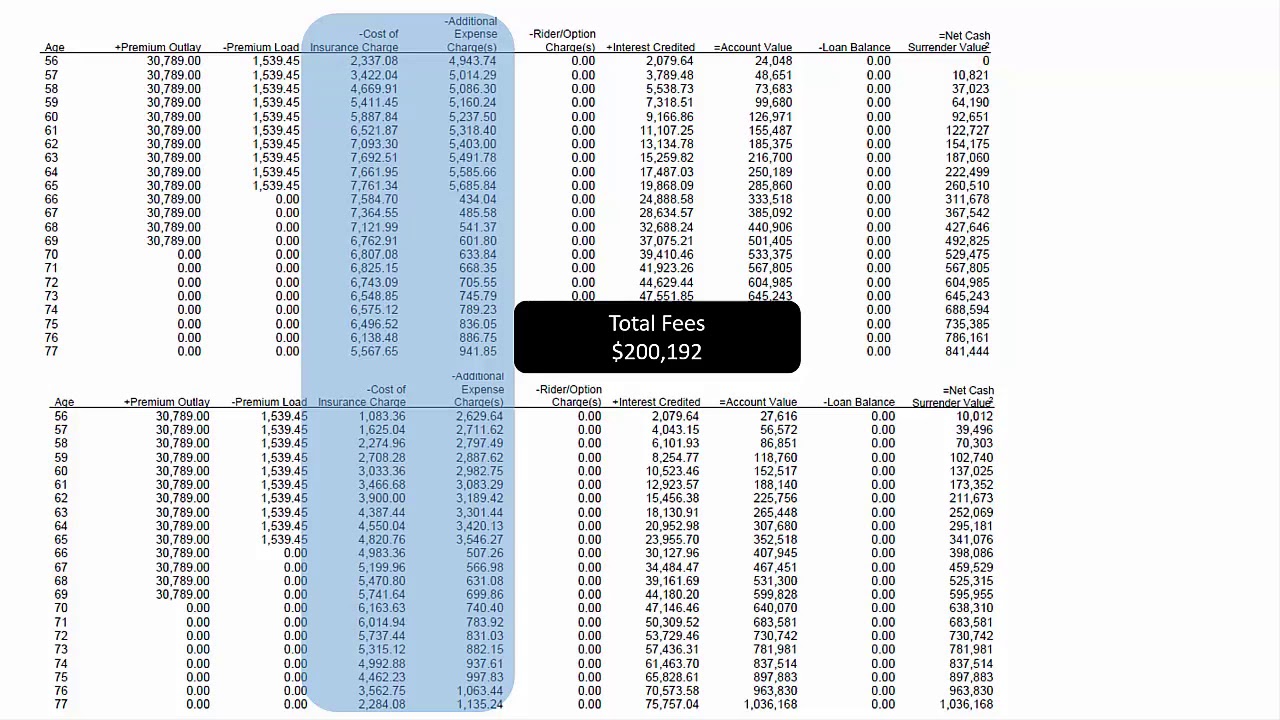

Index Universal Life Insurance Quotes

Funding Costs: Financings versus the plan accrue interest and, if not settled, lower the death benefit that is paid to the recipient. Market Participation Limits: For most policies, financial investment growth is linked to a securities market index, however gains are generally covered, restricting upside potential - words ending in iul. Sales Practices: These policies are typically sold by insurance policy representatives that may stress advantages without totally explaining costs and dangers

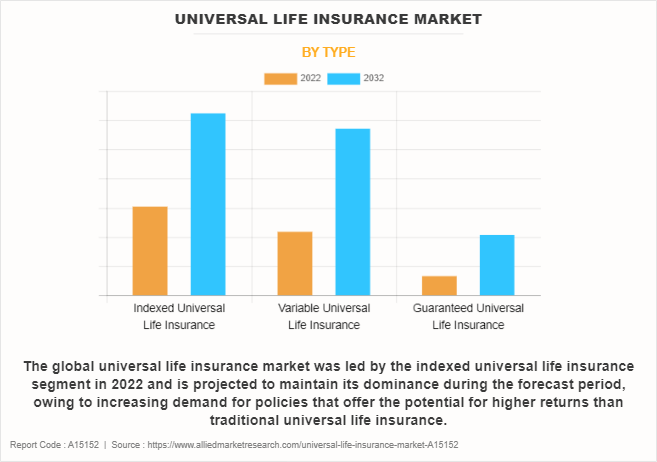

While some social media pundits suggest an IUL is a substitute product for a 401(k), it is not. Indexed Universal Life (IUL) is a kind of permanent life insurance policy that likewise offers a money worth part.

Latest Posts

Indexed Universal Life Insurance

Best Iul Insurance Companies

Top 10 Best Indexed Universal Life (Iul) Insurance Companies